Before looking at what parametric insurance means, let’s first understand how traditional insurance works. Typically, the insurance company issues a policy, and if there is a loss, the customer files a claim. Adjusters from the insurance company then look at the claim to validate if it’s legitimate, and at the same time, determine the payment amount.

In this scenario, the customer does not know the exact payment they will receive, because it’s up to the adjusters to review the policy, exclusions, and other details before deciding the payout. Sometimes this can be a long, tedious process because adjusters have to perform a lot of verifications working with vendors, service providers, witnesses, and so on. To overcome these drawbacks with traditional insurance, a product called parametric insurance was introduced.

What Is Parametric Insurance?

Parametric insurance is when the insurance company determines a specific event while issuing the policy. For example, in a homeowner’s policy, the insurer might state: If your home is damaged by wind reaching 100 kilometers per hour, we will pay you $10,000.

In this example:

- The predetermined event is wind speed reaching 100 km/h.

- The predetermined payout is $10,000.

A critical aspect of parametric insurance is data accuracy. The insurance company must be able to obtain reliable data from third-party vendors to confirm the event occurred. If accurate data cannot be obtained, the policy may face issues.

Parametric insurance is a predetermined payout based on a predetermined event, provided the required data is available.

Examples of Parametric Insurance

- Pay $100,000 if an earthquake with a magnitude of 5.0 or greater occurs in a specific area.

- Pay $5,000 if a scheduled flight on January 16th at 5:00 PM is delayed by 5 hours.

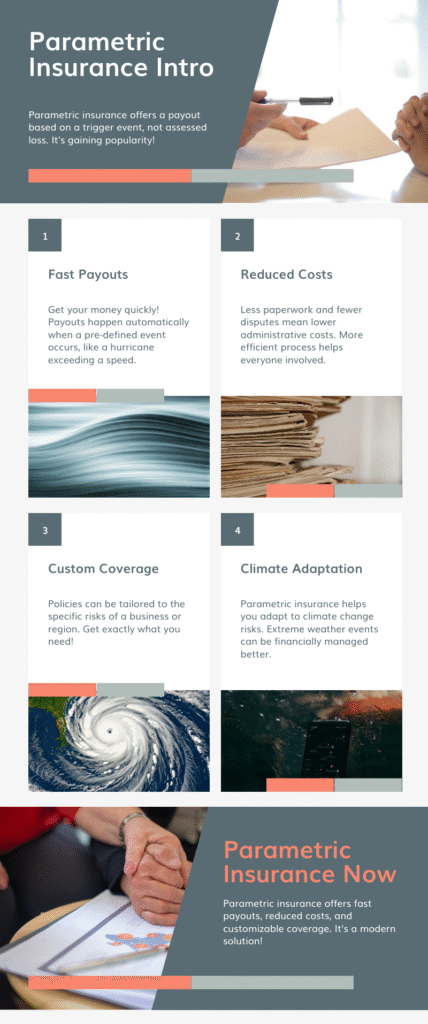

Parametric Insurance Infographic:

Traditional Insurance vs. Parametric Insurance:

In traditional insurance, the process usually works like this:

- The insurance company issues a policy.

- If a loss occurs, the customer files a claim.

- Adjusters verify the claim’s legitimacy, review policy exclusions, and determine the payout.

This process can be slow and unpredictable. The customer often has no idea what the final payment will be until the insurer finishes its review. Adjusters may need to work with vendors, witnesses, and service providers making it a tedious experience.

How it Works?

Parametric insurance works by automating the payout process based on predefined parameters. First, the insurer and policyholder agree on measurable parameters or triggers, such as rainfall level, wind speed, or earthquake magnitude, that would cause a payout. Next, independent data sources such as satellites, weather stations, or seismic sensors continuously monitor these parameters.

When an event occurs that meets or exceeds the predetermined threshold, the system automatically verifies the data against the trigger conditions. Once these conditions are met, the policy processes the claim and releases the payout to the policyholder without the need for a lengthy claims adjustment process. Because the process relies on objective data and predefined rules, it minimizes disputes and speeds up payouts, offering financial relief much faster than traditional insurance models.

Unlike traditional insurance, which requires you to prove your losses, parametric insurance pays out based on predefined conditions. In other words, if a certain event happens like an earthquake above 7.0 magnitude or rainfall dropping below a certain level you get paid. There’s no need for damage assessments and no waiting for adjusters, just a fast and fair payout.

Here’s a real example: small scale farmers in USA use parametric insurance to protect their crops from drought. If rainfall falls below a set threshold during the growing season, they automatically receive a payout to cover their losses. This allows them to buy seeds for the next season without financial ruin.

A recent proposal called the WEATHER Act of 2025 urges the U.S. Department of Agriculture (through the Federal Crop Insurance Corporation) to develop multi-peril index-based (parametric) insurance. The plan would tie payouts to county level data such as rainfall, wind, drought, and other weather events with the aim of delivering payments within 30 days of a trigger event.

Common Misconceptions

One big misconception is that parametric insurance replaces traditional insurance. This is false.

For instance, if you set $10,000 as the payout for a homeowner, the actual loss could be $25,000. Parametric insurance will not give 100% coverage it is meant to complement traditional insurance. Its main role is to provide immediate relief. For example, after an earthquake, traditional insurance may take time to review and pay the final amount. Parametric insurance, on the other hand, can give you an immediate payout to handle urgent needs. Often, customers buy parametric insurance to cover items excluded from traditional policies such as fences or specific damages offering limited but quick coverage.

Parametric insurance was developed to overcome these drawbacks.

The Role of Data in Parametric Insurance:

For parametric insurance to work, accurate and reliable data is essential. Insurers often partner with third-party providers to track:

- Wind speed

- Earthquake magnitude

- Rainfall measurements

- Flight delays

- Temperature extremes

Data is the key to parametric insurance. Thanks to technologies like IoT devices, artificial intelligence, big data, and blockchain, accurate data is easier to obtain. As a result, payments can be processed in minutes, hours, or seconds once an event is confirmed. This quick payment helps customers manage immediate expenses until they receive the full settlement from traditional insurance.

Real Word Applications:

Parametric insurance is making an impact in many areas. In natural disaster relief, hurricanes and earthquakes trigger policies based on set wind speeds or seismic readings, allowing quicker relief in the aftermath. In agriculture, farmers receive payouts based on rainfall levels, drought indices, or temperature extremes. In travel, some companies use parametric triggers for flight delays or cancellations, paying compensation instantly.

In the energy and commodity markets, parametric insurance can cover renewable energy shortfalls due to adverse weather conditions, such as low wind speeds affecting wind farms. Some products hedge against commodity price fluctuations, paying out when prices fall or spike beyond a set point. It also helps with event cancellation, microinsurance in developing regions, and infrastructure or supply chain disruptions. By leveraging real-time data, satellite imagery, and analytics, it minimizes administrative hassles and speeds up payouts.

Why It’s the Future of Insurance?

Parametric insurance offers faster payouts, reduced administrative burden, enhanced transparency, better disaster response, and improved risk management. Coverage can be customized for specific risks, such as droughts, floods, or pandemics, making it suitable for high-risk areas. It encourages innovation by integrating AI, blockchain, and IoT devices, is scalable across industries, and supports climate change adaptation. With technological advancements, parametric insurance is set to become even more precise and efficient.

Finally, Parametric insurance is an important tool, but remember it works best as an additional option, not a total replacement for traditional insurance.